Current events bring geopolitics and the dynamism of the Arabian Gulf to the fore with three players who, for 10 years, have distinguished themselves by their proactive strategy in strengthening their defense capabilities: Saudi Arabia (KSA), Qatar (QTR) and the United Arab Emirates (UAE). These resource-rich nations located at key strategic points face internal and external security challenges, motivating sustained military modernization and economic diversification. Let us review their specificities as well as their strategies and how foreign companies, especially from European, can position their expertise.

Mix of Public / Private and Decision-Making Entities

Existing dynamics of the defense sector in the region require close interaction between public and private entities. Companies such as SAMI in Saudi Arabia, EDGE in the United Arab Emirates, and Barzan Holdings in Qatar, exemplify this desire for balance and their will to develop national defense capabilities with the support of their sovereign wealth funds.

1. SAMI (KSA)

SAMI (Saudi Arabian Military Industries) is a Saudi state-owned company established in 2017 to develop national defense and security industries. This national champion is responsible for manufacturing, maintaining, and repairing military equipment for the Saudi Armed Forces. SAMI works closely with the Ministry of Defense and the Armed Forces to develop innovative and effective defense solutions. Its goal is to become one of the top 25 OEMs (Original Equipment Manufacturers) in the world. SAMI can draw on a defense industrial history existing for more than 40 years. In addition, there are industrial companies resulting from offset programs as well as the support of Saudi private industrial groups. This thorough ecosystem feeds already the military industry’s supply chain. The specific goal? To localize 50% of military spendings assessed at $70 billion per year.

2. EDGE (EAU)

EDGE is an Emirati state-owned company established in 2019 to develop the national defense and security industries. Like its Saudi counterpart SAMI, it is responsible for manufacturing, maintaining, and repairing military equipment for the Emirati armed forces. EDGE also works with the Ministry of Defense and the Armed Forces to support research and development.

3. Barzan (QTR)

Founded in 2018, Barzan is a state-owned company in Qatar dedicated to the development of the defense and the national security It plays a key role in the production, maintenance, and repair of military equipment for the Qatari Armed Forces. Engaged in close collaboration with the Ministry of Defense and military units, Barzan is committed to designing defense solutions that are both innovative and efficient.

Common Defense Strategies

Despite their specificities, starting with their differences in populations and areas to be covered; KSA, QTR and UAE share common defense strategies focused on military modernization, technological innovation, industry localization and, to a lesser extent, regional cooperation. These strategies include strengthening missile defense capabilities, investing in electronic warfare and cybersecurity, and developing a robust and independent local Defense Industrial and Technological Base.

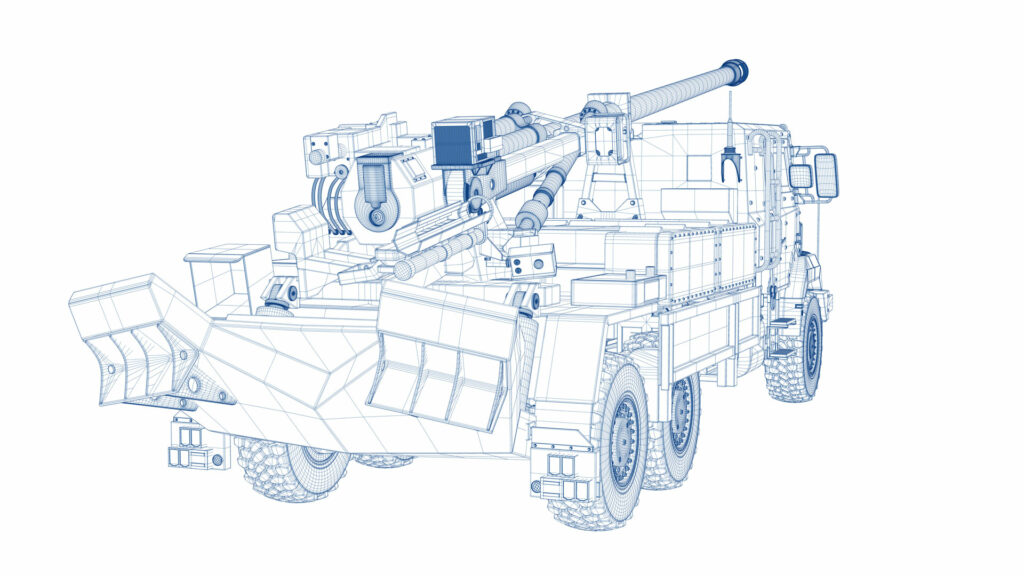

1. Modernization and Diversification of Military Capabilities: KSA, QTR, and the UAE are investing heavily in the modernization of their armed forces, including the acquisition of state-of- the-art equipment and the development of indigenous capabilities. This is intended to reduce dependence on foreign suppliers and improve regional deterrence.

2. Focus on Technology and Innovation: Cyber defense, artificial intelligence, drones, and autonomous systems are areas of common These technologies are seen as ways to gain strategic advantage and improve operational efficiency. Robotic solutions and cobotics are also valued.

3. Security and Defense Cooperation: Despite occasional tensions, the three countries participate in regional security initiatives, cooperate in the fight against terrorism, and engage in joint military exercises with regional and international partners to strengthen regional stability.

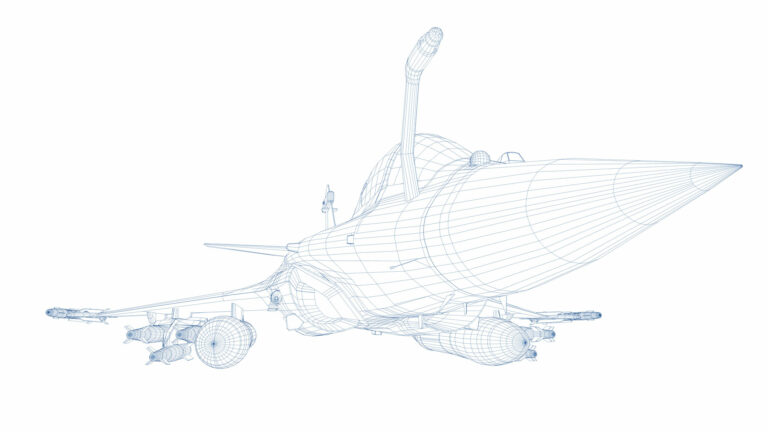

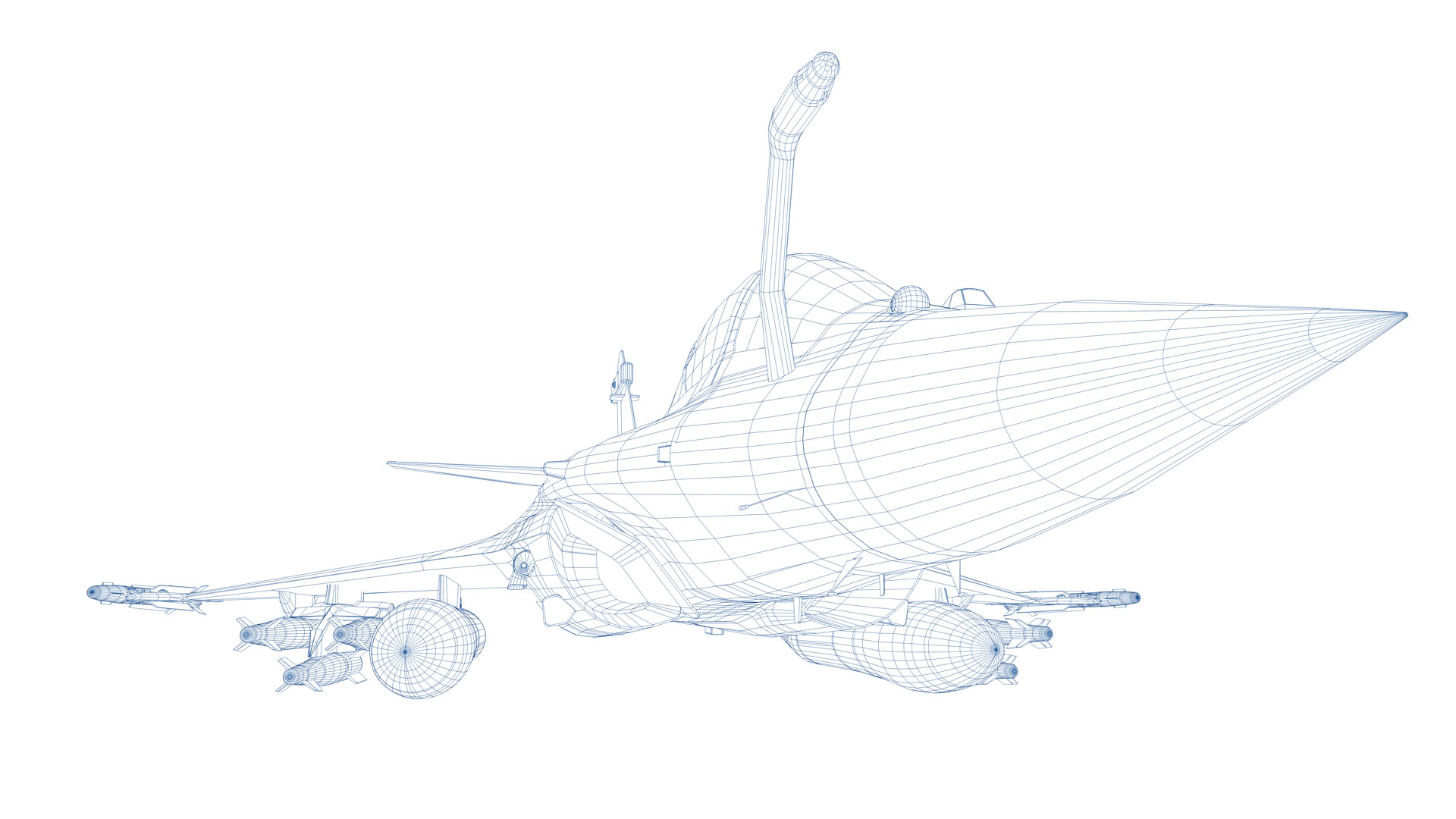

4. Strengthening Drone, Missile and Air Defense: Facing ballistic missile and drone threats from neighboring conflict zones particularly in the Red Sea; KSA, QTR, and UAE have invested in sophisticated missile defense systems such as the Patriot PAC-3 and THAAD (Thermal High Altitude Air Defense) to protect their territory and critical infrastructures, especially related to oil and gas, but also to tourism and to religion.

5. Strategic Partnerships with Foreign Powers: Collaboration with countries such as the United States, European countries, or Turkey for the acquisition of defense technologies, military training, and intelligence is a central pillar of their defense These partnerships help build their military capabilities and ensure strategic and doctrinal alignment. Emphasis is placed on the supply chain, as well as technical and operational support. Much of it is being localized in the region and accompanies the current challenges, which are more than ever multidimensional.

6. Focus on Maritime Security: Recognizing the importance of sea lanes security for trade and the supply of energies; KSA, QTR, and the UAE are investing in the development of their maritime forces and their coastal surveillance capabilities to protect critical trade routes and prevent piracy, terrorism, and destabilization attempts. 2023 and 2024 revealed and still shows the extent to which straits and canals can become areas of tension, where warring parties’ innovation takes sometimes renowned armies by Current incidents which occurred to access the Red Sea through the Strait of Bab El-Mandeb or through the Suez Canal, where 10% of the world’s oil trade transit with 5 million barrels per day, but also 30% of containerized traffic (source); shows how combatants have managed to disrupt the international trade with small means compared to the additional costs generated for the concerned countries (military forces deployment, extension of delivery times, insurance premiums increase…).

7. Development of the Local Defense Industry: There is a joint effort to develop the local defense industry to support strategic autonomy. This includes initiatives to encourage research and development in the defense sector and attract foreign investment. Many subsidies and direct aid are available to foreign investors to facilitate the localization of their technologies. The same applies to the establishment of local production subsidiaries to ensure sustainable supply. All maintenance competencies need for example to be developed and strengthened: spare parts, maintenance, retrofit of platforms and systems, upgrade and modernization, technical assistance, training. Objectives are to guarantee all platforms and systems operational availability throughout their life, as well as human resources competencies.

Specific Development Axes for Defense Contracts

Saudi Arabia (KSA):

Under the aegis of its Vision 2030, it is embarking on an ambitious program to reduce its dependence on oil, diversify its economy, and develop key sectors, including defense and security. Vision 2030 includes specific targets to strengthen the national defense industry, with the firm intention of localizing more than 50% of military spending.

This involves significant investments in research and development (R&D), the acquisition of advanced technologies, and the establishment of strategic partnerships with foreign companies to transfer knowledge and skills.

The focus is on acquiring indigenous capabilities to manufacture weapons and to develop cybersecurity, air and missile defense systems, as well as anti-drone systems; aiming to create a self-sufficient and innovative defense industry. Finally, Saudi Arabia is the custodian of the two holy mosques and welcomes more than 9 million pilgrims each year.

Qatar (QTR) :

Qatar, through its National Vision 2030 (QNV 2030), aspires to transform its economy for sustainable development by focusing on four pillars: human, social, economic, and environmental development. In the area of defense and security, Qatar has significantly increased its investments to modernize its armed forces and improve its internal security capabilities, particularly in anticipation of major international events such as the 2022 FIFA World Cup. This includes the acquisition of state-of-the-art equipment, such as Rafale fighter jets, and the strengthening of the security of critical infrastructures.

Qatar also emphasizes international cooperation to improve its counter-terrorism capabilities and ensure regional security. Qatar, known for its natural gas wealth, is also investing in modernizing the protection of its gas, processing, and transportation infrastructures.

United Arab Emirates (UAE):

The UAE has established innovation and innovative technologies as central pillars of its defense strategy, incorporating government guidelines positioning the country as a global leader in the fields of Artificial Intelligence (AI), autonomous systems, and cybersecurity.

The UAE is investing heavily in R&D to develop domestic capabilities in these sectors, including the launch of ambitious projects such as the smart and sustainable Masdar City and the UAE Space Agency.

In defense, these technologies are being applied to improve surveillance, reconnaissance, and combat capabilities, with a focus on drones, electronic warfare systems, and cyber warfare. The aim is to create an agile and technologically advanced defense force, capable of responding effectively to contemporary security challenges.

Strengths & Opportunities

Industrialization projects open new opportunities for manufacturers who understand the challenges and contexts, analyze the associated risks and are visionary for this high-growth region whose projects have shifted from an acquisition strategy to an industrialization strategy across the entire subcontracting value chain. The competitive environment prevails with possible geopolitical support from governments, technical benchmarks of solutions and contextual analyses of capabilities; but which must be combined with the resources and wills of local industrial partners: those « champions » supported by sovereign wealth funds and those emerging who are private. Implementation strategies are becoming complex, personalized, and shared with local partners to set up an industrial base of solutions and services that go beyond the sector concerned and require interfacing with many ministries to create a real industrial sector.

After initial announcements at defense fairs, contracts are difficult to sign for various reasons: the absence of heavy industry in support, competition position of national « champions » in acquisition processes that still exist within the armed forces, the neutralization of national public and private players, the absence of localization plans, contracting skills and capability studies allowing concrete and sustainable acquisition programs, the lack of support structures (test centers, maintenance, logistics flows, etc.), services (employment doctrines, operational management, education, and training, etc.) and regulations. These are all blocking points but also opportunities for manufacturers who can develop a global vision and partnerships that go beyond their main activities.

KSA, QTR and UAE understand the challenges of global diversification for acquisitions allowing greater access to unrestricted export licenses, innovative technologies adapted to their desire to develop an already well-established Industry 4.0, and platforms adapted to their needs. It is through relationships of trust that the desired synergies will be developed: platforms adapted to respond to asymmetric and hybrid threats, greater interoperability in operations, economies of scale through standardization of platforms, sharing of assembly lines, regional test and maintenance centers.

More than ever, relations between foreign countries and the countries of the Middle East require a visionary and geopolitical approach, supported by strategic exchanges between governments, but also supported by the industrial courage of foreign companies and their industrial sectors to transfer technologies, knowledge, and culture in an approach of total transparency, trust, and risk sharing. The big winners (countries, industrial companies, industrial sectors) will be those who « Saudise », « Qatarise » and « Emiratise » their strategy first!

The Role of META 2c

META 2c is a Saudi-French company that positions itself as a catalyst, a key and unique facilitator in the relationship between European companies and industrial markets in the Arabian Gulf countries, in particular for the development of technologies in the defense sector. By offering services such as business expertise (including engineering), market analysis, strategic planning and project management, META 2c helps its clients navigate the complex landscape of the defense industry sector and the cultural differences of the business world, identify partnership opportunities and tailor their offerings to the specific needs of the region.

The expertise and extensive network of its industrial and political experts in Europe, as well as the support of its partners, allow META 2c to build strong bridges between the West and the Arabian Gulf, fostering innovation and growth in the defense, industrial, innovation, technological and energy sectors; paving the way for new collaborations. We support from start-ups to large accounts and remain attentive to your project.